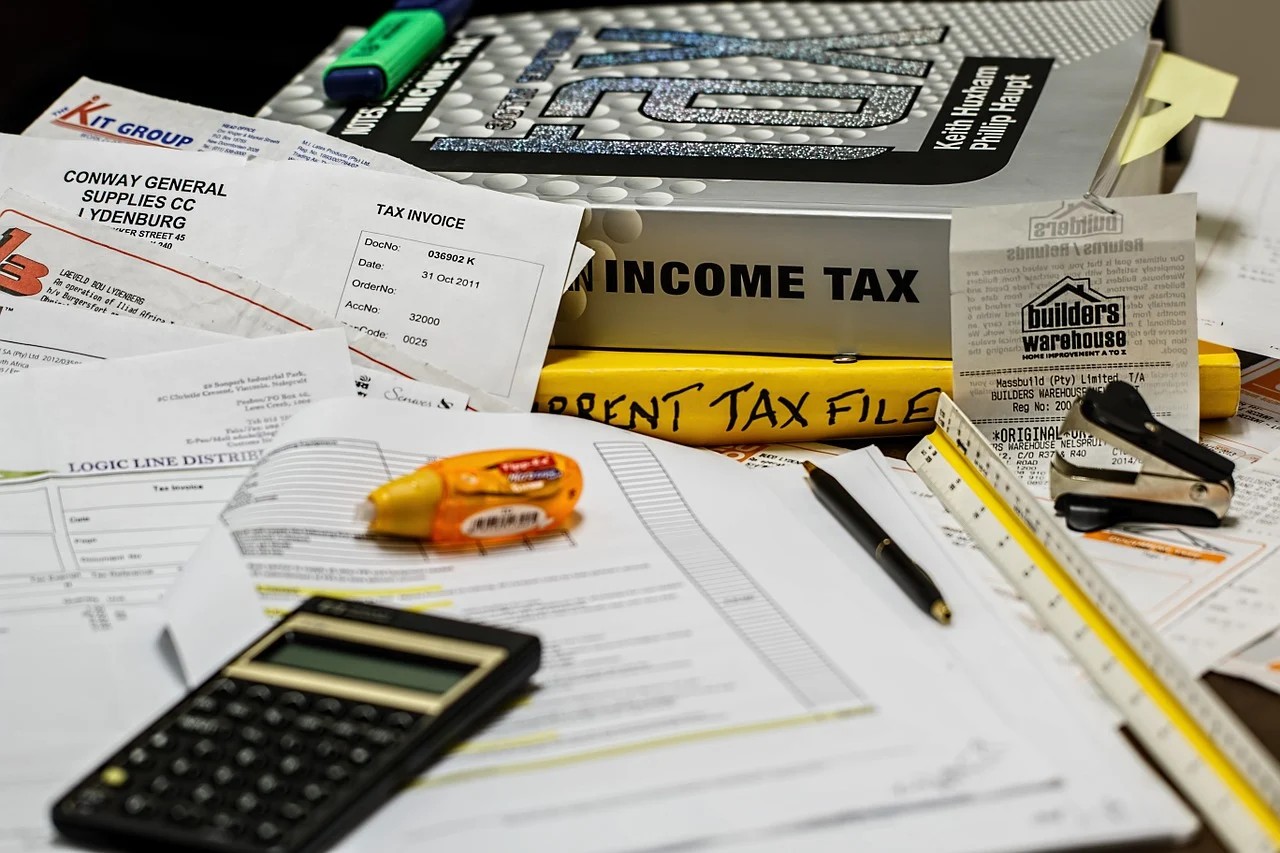

INCOME TAX RETURN – ITR

Get fast, Affordable & Accurate taxation & consultancy services. File your income tax return with us hassle free.

ACCOUNTING / BOOK-KEEPING

Get customized accounting packages, which is best suitable for your business. Get started at Rs. 15000

GOODS AND SERVICE TAX- GST

Get one stop solution to all your GST and its compliance needs. Get registration, Filings and compliance assistance all at one place.

COMPANY REGISTRATION

Register your business with us. Get a quick private company registration at lowest cost i.e. Rs 7000 within 7 days.

CORPORATE COMPLIANCE

Lessen your corporate compliance burdens with us. Don’t be afraid from the rigid compliances applicable to companies when we have your back.

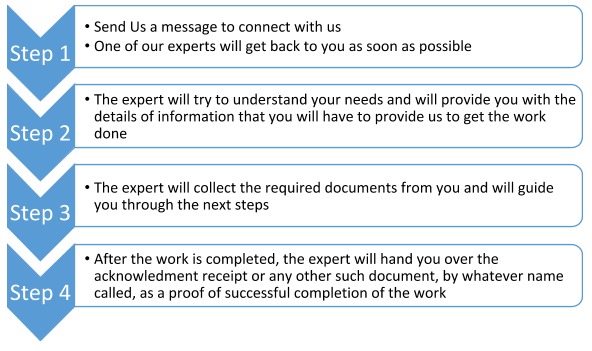

About Us

We at EazyBahi Solutions provides bookkeeping and compliance solutions for businesses and individuals. We are a team of experts extending our services to you. We ensure hassle-free services of compliance and bookkeeping. Our services will help you meet the legal and statutory obligations of your business.

We make compliance easy for you.

EazyBahi solutions caters to the needs of businesses, professionals, and other individuals. We are here if you seek help in bookkeeping, taxation, and corporate laws. Our team of Chartered accountants, company secretaries, lawyers are ready to assist you.

You can focus on what you’re best at, while we work at the bottom line to make your business compliance-ready.

Important Dates

Our Services

We provide a range of services customized to suit your preference

Book Keeping

Get customized accounting packages, which is best suitable for your business. Get started at Rs. 15000

Company Registration

Register your company at The lowest cost within 7 days. Get started at Rs. 7000

Non corporate compliances

Do not afraid for day to day statutory compliances when we have your back. Get stared at Rs. 5000.

GST Registration

Get registered in GST and file your monthly, quaterly and annual gst returns on time. Get started at Rs. 1000

Corporate Compliance

Dont be afraid from the rigid compliances applicable to companies when we have your back. Get started at Rs. 15000