Insurance

Get help in choosing the right insurance policy for you.

Insurance

Insurance is a contract or a policy in which the “Insurer” indemnifies the “Insured” against certain risks or losses. In simple terms, any losses incurred by the “Insured” due to certain reasons as mentioned in insurance policy will be made good by the “Insurer” that is the Insurance Company.

There are various types of insurance some of which are listed below:

- Life Insurance

- Health Insurance

- Motor Insurance

- Property Insurance

- Mobile Insurance

- Travel Insurance

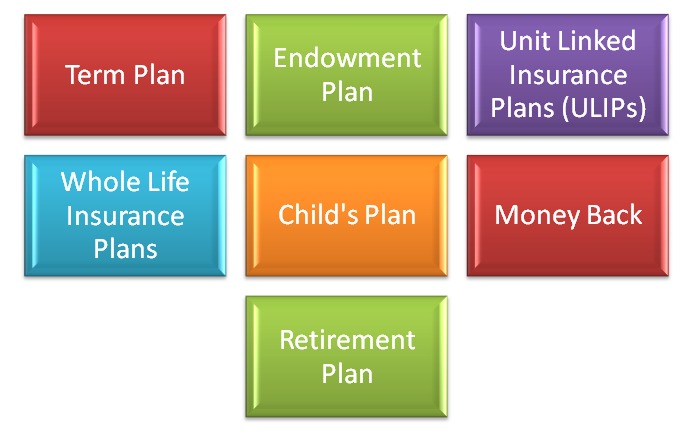

Life Insurance

Life Insurance is a type of insurance that provides a kind of financial security to the family of the insured in the event of his/ her death.

There are 7 different types of Life Insurance available which can be shown as follows:

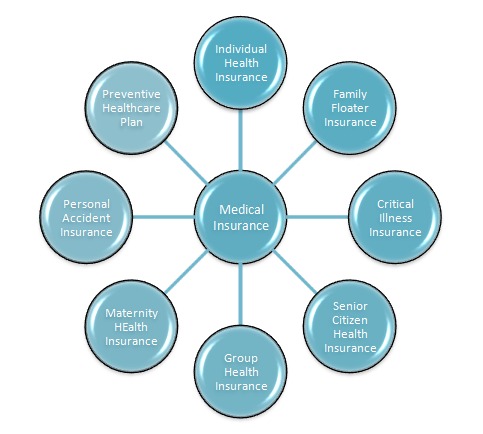

Health Insurance

It is a type of insurance taken to cover the medical expenses in the event of hospitalisation of the policy holder. In some cases it also covers the expenses incurred at home before hospitalisation or after discharge from the same.

There are 8 kinds of medical insurance:

Motor Insurance

This type of Insurance is taken to protect against the financial loss caused due to damage of motor vehicles in the event of any accident.

There are 3 categories of Motor Insurance namely:

Car Insurance

2 wheeler Insurance

Commercial vehicle Insurance

Travel Insurance

It ensures the financial security of a traveller during a trip. It provides financial assistance in the event of loss of baggage, trip cancellation, flight delay, etc.

Benefits of Travel Insurance:

- Covers Financial Loss caused due to Flight Delay

- Claim for baggage loss

- Financial aid in reapplying for lost Passport, VISA, etc.

- Covers cancellation charges of flights, hotels etc in the event of an emergency.

Property Insurance

This type of Insurance provides financial cover to any immovable property being a residential house or a commercial building. Property Insurance can be used to raise claim for any damage caused to any such property. It also covers the content inside the property.

Types of Property Insurance:

Home

Shop

Office

Building

Mobile Insurance

It covers the expenses incurred for repairing the mobile phone. It can also be used to raise claim in the event of theft of mobile phone.

Benefits of Mobile Insurance

- Safeguard to the value of mobile phone

- Cover against screen damage and other damages

- Covers theft or robbery of mobile phone